Ten electric or plug-in hybrid vehicles will be eligible for a $7,500 U.S. tax credit, while another seven could get $3,750 under new federal rules that go into effect on Tuesday.

But under the Treasury Department rules and other provisions of last year's Inflation Reduction Act, most of the more than 60 electric or plug-in hybrids on sale in the U.S. won't get any tax credits.

That could slow acceptance of electric vehicles and could delay reaching President Joe Biden's ambitious goal that half of new passenger vehicles sold in the U.S. run on electricity by 2030.

The new rules, which govern how much battery minerals and parts can come from countries that don't have free trade agreements with the U.S., bumped nine vehicles off the tax credit eligibility list that went into effect Jan. 1.

The 10 vehicles eligible for the full $7,500 credit are Tesla's Model 3 Performance model, the Tesla Model Y, Ford's F-150 Lightning pickup, the Chrysler Pacifica and the Lincoln Aviator Grand Touring plug-in hybrids. Also, General Motors will have five models eligible this year including its top-selling Chevrolet Bolt and Bolt EUV, as well as the Cadillac Lyriq, the Chevrolet Silverado electric pickup and the upcoming Chevy Equinox small SUV.

The seven models that could get a $3,750 credit include the Jeep Wrangler and Grand Cherokee plug-ins, Ford's Mustang Mach-E SUV, Escape plug-in and E-Transit electric van, the Lincoln Corsair Grand Touring plug-in and the standard range rear-wheel-drive version of Tesla's Model 3.

Consumers can check to see if the EV they're considering is eligible for a credit at www.fueleconomy.gov.

To be eligible, electric vehicles or plug-ins have to be manufactured in North America. SUVs, vans and trucks can't have a sticker price greater than $80,000, while cars can't sticker for more than $55,000. There also are income limits for buyers.

The Treasury Department says the new list shows that families who want to buy an electric or plug-in vehicle “will continue to have a number of options to receive a full or partial tax credit in the near term" under rules designed to build electric vehicle production and a supply chain in the U.S.

The reduction in eligible EVs also could conflict with the administration's proposed strict new automobile pollution limits announced last week. The new standards would require up to two-thirds of new vehicles sold in the U.S. to be electric by 2032. That’s a nearly tenfold increase over current electric vehicle sales.

Many of the vehicles that aren't eligible for the credit are made outside of North America, but their manufacturers are building assembly and battery plants in the U.S., and more vehicles will become eligible.

Some auto industry analysts say that while $7,500 would be enough to entice people away from internal combustion vehicles, a $3,750 tax credit might not be enough to offset the average U.S. new EV price.

Kelley Blue Book says the average U.S. new EV costs about $58,600, nearly $10,000 more than the average new vehicle price. To be sure, average EV prices are falling as more people buy less-expensive models. The average EV price was $63,500 a year ago.

Jeff Schuster, executive vice president of LMC Automotive and Global Data, said half of the full tax credit isn’t enough. “You’re shrinking the market essentially by the vehicles not being affordable,” he said, adding that the average combustion engine vehicle isn’t affordable either.

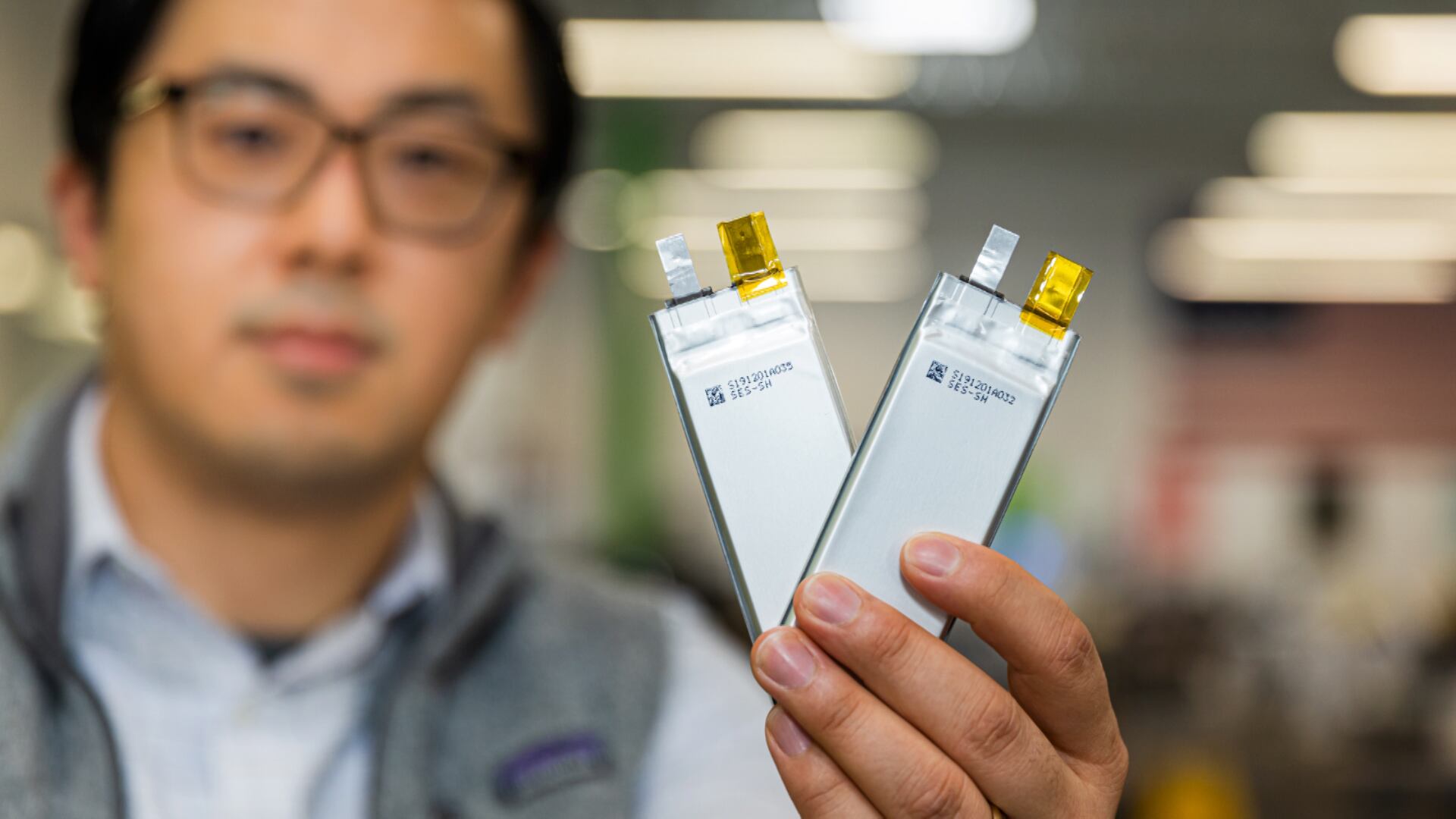

The big issue in the rules that are effective Tuesday are limits on the percentage of battery parts and minerals that come from countries that don’t have free trade or mineral agreements with the United States.

This year, at least 40% of the value of battery minerals must be mined, processed or recycled in the U.S. or countries with which it has trade deals. That rises 10% every year until it hits 80% after 2026.

Also, at least 50% of the value of battery parts must be manufactured or assembled in North America this year. That requirement rises to 60% next year and in 2025 and jumps 10% each year until it hits 100% after 2028.

In addition to the price limits, there also are income limits aimed to stop wealthier people from getting credits. Buyers cannot have an adjusted gross annual income above $150,000 if single, $300,000 if filing jointly and $225,000 if head of a household.

In addition, starting in 2025, battery minerals cannot come from a “foreign entity of concern,” mainly China and Russia. Battery parts cannot be sourced in those countries starting in 2024; minerals can’t come from those countries in 2025.

The Biden administration said rules governing that requirement are in the works.

Even though the rules are effective Tuesday, the Biden administration is taking public comments, and they can be modified later, including the addition of countries that negotiate trade agreements with the U.S.