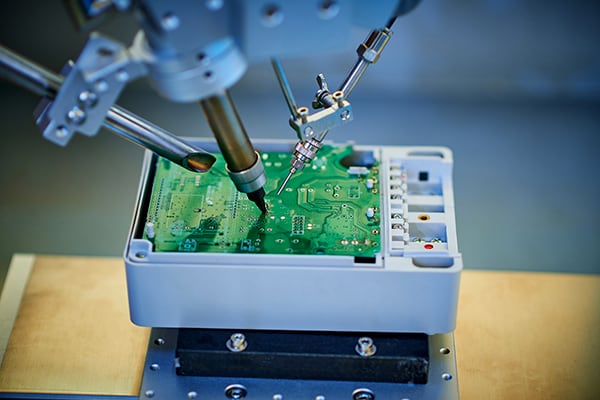

Chips are a trillion-dollar industry, and everyone wants to control it

The simultaneity that started it all! Fearing that a potential war between China and Taiwan could cut U.S. supplies of vital computer chips, the Biden administration began to pour billions of dollars in loans and subsidies into rebuilding a domestic chip-making industry. Simultaneously, China moved to build its own chips, and thus the AI revolution began.

Now the U.S., China and much of Asia are all jockeying for dominance in what could be the most vital industry of the 21st century. And while the U.S. designs the world’s best chips, the lucrative manufacturing industry is spread across three continents.

“The competition over semiconductors unfolding now is an industrial war,” South Korean President Yoon Suk Yeol told government and industry officials. “An all-out war between countries.”

South Korea has set aside about $450 billion in private investment for next-generation chip-making, about as much as the U.S., The Wall Street Journal reported. Yoon’s government is planning the world’s biggest chip-making cluster in South Korea, with 37 factories across eight cities and creating three million jobs.

In China, Semiconductor Manufacturing International Corp., or SMIC, is the largest domestic chipmaker, but its technology is several generations behind industry leaders Taiwan Semiconductor Manufacturing Co. and Samsung. In an effort to wean itself from U.S. technology — like chip-making machines — SMIC is building its own tools, but this too appears several generations behind the U.S., Taiwan and South Korea.

In the end though, it may be the companies most plugged into the global supply chain that will lead the market. Taiwan’s TSMC has just announced plans for a new $7.8 billion chip plant in Singapore, in a joint venture with Singaporean and Dutch chip makers. And TSMC is also building three new “fabs” or chip plants in Arizona.

The Usual Suspects

- Can electric cars form the new grid? Carmakers are finally exploring ways to use dormant car batteries to power the world. As The New York Times reports, “Millions of cars could be thought of as a huge energy system that, for the first time, will be connected to another enormous energy system, the electrical grid.”

- Media mania: The world keeps spinning and G/O Media keeps spinning off. Building on a promise to sell the mass of digital media companies he acquired over the past six years, private equity investor Jim Spanninger this week sold Gizmodo — the G in G/O — to a French tech media company, Keleops. So far G/O has spun off acquisitions including The Onion, Jezebel, Lifehacker, Deadspin and the A.V. Club. It still owns Quartz, Jalopnik, Kotaku, The Root, and The Inventory.

- Nvidia has overtaken Apple as the world’s second-largest public company by market cap, and there’s no sign the chipmaker will slow down as the AI boom — and demand for specialized chips — continues.

- Elon’s world: As Tesla shareholders prepare for their annual general meeting next week, Elon Musk and the board of directors want shareholders to approve a pay package now worth $46 billion (it fluctuates with the share price). The package was approved by the board in 2018, was delayed by a lawsuit and is now up for a vote. Some shareholders and proxy advisers say it’s way too rich and would dilute their holdings. But investor Ron Baron says shareholders can’t afford to let Elon go. “Elon is the ultimate ‘key man’ of key man risk,” Baron said. “Without his relentless drive and uncompromising standards, there would be no Tesla.”

It’s about to be a slam dunk

There’s nothing bigger than the big leagues, and the National Basketball Association is on the verge of a signing that makes Steph Curry ($51.9 million a year), Kevin Durant ($47.6 million) and LeBron James ($47.6 million) look like minnows.

A television rights deal with NBC, ESPN and Amazon is in the works and would be worth $76 billion over 11 years, The Wall Street Journal reported. The deal comes as traditional media companies are increasingly worried about competition from streaming and the collapse of cable. But despite its vast expense, sports seems like the only surefire way to draw audiences.

“Entertainment is a swamp, and sports is the only firm ground,” former Fox Sports chief David Hill told The Journal. The channels would divvy up the league’s games and ESPN would be able to air games on its direct-to-consumer streaming service set to launch next year.

The deal will also set the NBA up comfortably for the next decade. The same can’t be said of the NFL, America’s favorite violent pastime. The league is facing a $21 billion lawsuit accusing it of violating antitrust law and harming consumers with its “Sunday Ticket” telecast package of games.

Originally brought by a San Francisco pub called The Mucky Duck, it’s now a class-action suit joined by millions of fans, who argue the teams unfairly banded together to sell their TV rights, and force fans to pay through the nose to watch out-of-town games that are free in teams’ homemakers. A win for the fans might ultimately be their loss, removing local games from broadcast TV.

The U.K.’s M&A frenzy is killing the shorts

It ain’t easy being short. That’s a message learned the hard way by short sellers who lost between $7 billion and $9 billion since 2021 in two rounds of betting against GameStop, when their short positions turned the troubled U.S. video game retailer into a chart-soaring meme stock.

Now some major investment funds that like to short more substantial stocks have gotten burned as the objects of their investment scorn quietly attracted takeover offers. As the Financial Times reports, Millennium Management, GLG and Gladstone Capital Management got hammered when companies including financial services company Hargreaves Lansdown (up 50 percent in the past month); cyber security provider Darktrace (up 67 percent in the past 6 months); and video game services company Keywords Studios (up 90 percent in the past month) saw their shares soar after attracting offers.

The culprit? Foreign rivals that saw a cheap way into the U.K. market, as well as private equity firms that saw distressed assets at an attractive price. M&A in the UK is up 84 percent this year, on shrinking valuations for British firms cut off from the European Union markets after Brexit — making them cheap for American competitors.

“Shorting any UK mid-cap is insane, literally insane,” an unidentified short-seller told the Financial Times. Fun!

Peter S. Green is a veteran reporter and editor who has spent more than two decades covering business and finance from Eastern Europe to New York City, and has worked for Bloomberg News, The New York Post, The New York Times and The Messenger. He lives in New York City and is always looking for the next big story.