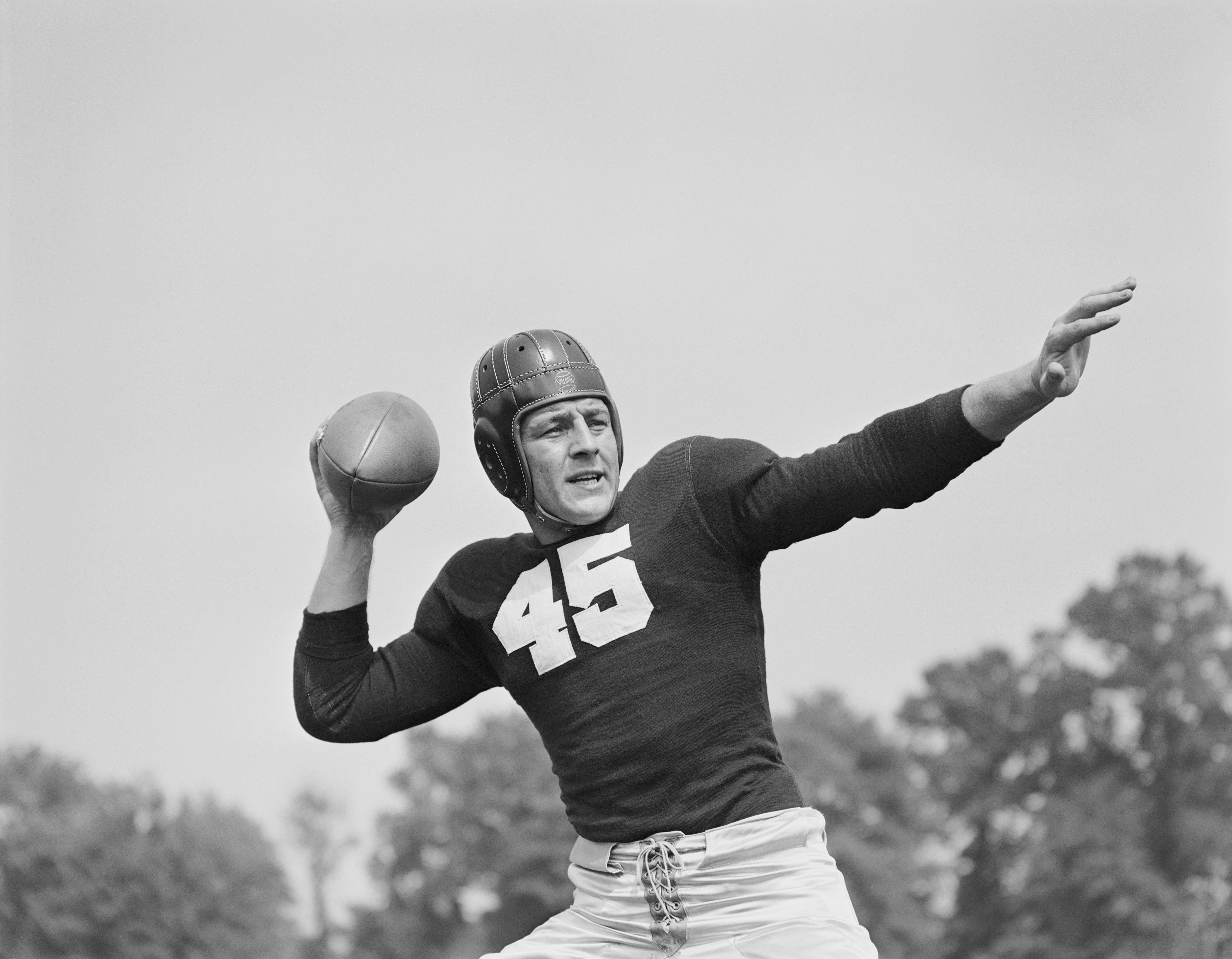

Private Equity’s Next Touchdown

NFL owners must be tired of holding all that value locked up in illiquid football teams. On Tuesday, they voted to let themselves sell minority stakes in their teams to a select group of private equity firms that has pledged to invest up to $12 billion across the league. Each of the 32 teams can sell up to a 10% interest to any of the selected PE groups. That could hand Jerry Jones—owner of the Dallas Cowboys, the most valuable NFL franchise—and his family more than $1 billion in cash without giving up control.

Owners have complained for several years that the mega-valuations have made it hard to sell their teams because few individuals have the necessary cash. “The law of big numbers is kicking in,” an anonymous investor told the Financial Times. Private equity investors already own chunks of professional baseball, hockey, basketball, and soccer teams. Private equity owners are renowned for finding ways to milk profits from their investments then discard them. Remember Red Lobster? Hertz? Toys R Us? All eyes are now nervously watching how PE ownership could change the game. The New York Blackstones versus the Washington Carlyles, anyone?

Get Big Business This Week in your inbox every week—and read it before everybody else! Sign up today.

The Usual Suspects

- Elon’s World: Elon hired a top GOP political consultant to guide his donations, even as Trump shoved him aside, saying he’s sure Elon is too busy to serve in the Cabinet. • Speaking of hot air, local environmental and health advocacy groups in Memphis say xAI’s data center there—run on 18 new gas-powered turbines—is producing some of the worst smog in the U.S. • Maybe the smog will go away now that Musk has caved to a threat from several state governments to rein in Grok’s election falsehoods. Now Grok will direct queries about the election to the government’s vote.gov website. • X employees, meanwhile, are awaiting news of how they will be moved from San Francisco to Texas, and have given up on expecting promised stock-like awards in the private company. • Musk appears to be trying to pre-empt a nationwide push to tighten the reins on AI by endorsing a California bill that would make (surprise!) tech companies responsible for safety testing AI and guarding against cyber-attacks. • Elsewhere, Musk is quietly asking the Canadian government to rescind its 100% tariffs on EVs imported from China, while a Brazilian judge is threatening to block X unless Musk enacts data privacy protections. • Back on Earth, the U.S. Federal Aviation Administration grounded SpaceX’s Falcon 9 rocket after one failed to land safely after a satellite mission.

- Trillion-Dollar Man: Warren Buffett’s Berkshire Hathaway, the holding company that has made the value-investing king one of the world’s wealthiest men, is now a trillion-dollar company. Class A shares were trading above $695,000 Thursday.

- OpenAIng Their Wallets: ChatGPT owner OpenAI is raising billions more dollars from investors, including Thrive Capital and Microsoft, and possibly Apple, that now value the closely held company at over $100 billion.

- Yelp Yelps at Google: You may have noticed Google’s own review system every time you search for takeout tacos. Well, Yelp now says Google’s unfairly blocking its business and has sued the search giant, claiming a years-long plot to stymie Yelp’s ability to reach consumers via Google search.

- Failing Grades: The Supreme Court once again hammered student borrowers, putting a hold on President Biden’s newest plan to wipe out hundreds of billions of dollars in student loan debt, while lower courts hear a case brought by a group of GOP-run states.

- Paramount to Bronfman: Show Me the Money. Former Warner Music and Vivendi Universal chief Edgar Bronfman abandoned his last-minute bid to buy Paramount after he couldn’t prove he had $4.3 billion in cash. Paramount will now go to Skydance Studios.

FTC: Just Say No to Big Grocery

Believe it or not, grocery prices are coming down, at least in terms of the number of hours the average American has to work to fill their shopping cart. According to data from the Bureau of Labor Statistics, Americans are now working 3.6 hours a week to buy food, about the same as when the pandemic started. But antitrust regulators say that could change if America’s two largest supermarket chains, Kroger and Albertsons, are allowed to merge. Kroger wants to buy Albertson’s for $24.6 billion, but the Federal Trade Commission says the move, which would give the combined business 13% of U.S. grocery sales, would just let Kroger’s raise prices, making ordinary Americans pay more for their groceries, and stifling competition. Kroger’s and Albertsons say they need to combine to compete with Costco, Amazon, and Walmart, which have muscled into the grocery aisle in recent years. When the trial opened this week in Portland, Oregon, Kroger’s lawyers noted that Walmart is the real monopolist, with 22% of U.S. grocery sales.

Chipping Away at Nvidia

It’s been a helluva year for Nvidia, the chipmaker that seemingly powered out of nowhere to become the darling of business, tech, and the stock market. But its growth appears to be slowing, a potential indicator that the AI market may take longer to get rolling than some investors—at least those who jumped on the stock—may have hoped.

While sales and earnings more than doubled in the last quarter to $30 billion and $16.6 billion respectively, gross profit margins shrank compared to the quarter that ended in April. Nvidia says the slowdown is a blip, due to some needed design tweaks on its next-generation chip, but it appears that investors may be concerned that investment in Nvidia, whose market cap is now about $3 trillion, may have surged too quickly. Shares are up 150% this year alone, but they fell 6% in after-market trading once the results were announced. (Through midday Thursday, shares were down 4.2%.)

Nvidia so dominates the AI chip industry that its results have become a leading indicator of the health of the AI boom, and despite some investors’ feeling the shares are overpriced, a recent sales forecast from tech consultants Gartner expects Nvidia to sell $84 billion of chips, up from a previously forecast $71 billion. The big buyers? Other tech companies, including Microsoft, Google, Amazon, and Meta, which are all building out substantial AI services for themselves and their corporate customers. In fact, business is so good for Nvidia that trustbusters from Paris to Washington are taking a look at the company.

International Relations

- That Was a Pricy Ride: Those pesky, privacy-minded Europeans just cost Uber $324 million, after the Dutch Data Protection Authority found Uber transferred personal info about its drivers in Europe to the U.S. without protecting the data from hackers.

- Corroded Deal? U.S. Steel may be losing a lifeline as unions and politicians slam the $15 billion deal to sell the venerable Pittsburgh-based steelmaker to Japan’s Nippon Steel. What went wrong? Nippon dissed the United Steelworkers union, ignoring it when the Japanese company held talks with U.S. Steel. Now with Pennsylvania a swing state, and both Dems and the GOP vying for votes there, the deal has become a political hot potato for politicians who will have to approve the deal.

The Phenomenal Kelce Brothers

Call it what you want, but the Kelce brothers’ latest deal is one of the biggest paydays in podcast history. Jason, the former Philadelphia Eagles center, and Travis, the Kansas City Chiefs tight end and Taylor Swift’s arm candy, have signed a three-year, $100 million deal with Wondery, Amazon’s podcast arm, for their popular “New Heights” podcast. The brothers have become one of the top podcasts on Apple Music, talking football, pop culture, and even UFOs, along with celebrity guest interviews, and Amazon is betting they have staying power.

“‘New Heights’ on the surface is a sports podcast, and sports is such a well-listened-to category,” Wondery CEO Jen Sargent told Variety, of the show. “But it’s become a cultural phenomenon,” she added. “They’re in that cultural zeitgeist.”

The brothers have savvily parlayed their own celebrity into a massively profitable franchise. Travis is also hosting a 20-episode season of Are You Smarter Than a Celebrity? for Amazon Prime Video, while Jason is premiering this season as a commentator for ESPN’s Monday Night Countdown pregame show. That still pales next to TayTay’s $2 billion payday last year, but maybe this is just Travis trying.

Peter S. Green is a veteran reporter and editor who has spent more than two decades covering business and finance from Eastern Europe to New York City, and has worked for Bloomberg News, The New York Post, The New York Times and The Messenger. He lives in New York City and is always looking for the next big story.